georgia film tax credit application

Certification may be applied for within 90 days of the start of principal photography but before the end of principal photography. Once submitted applications will become the property of the Georgia Department of.

Gftcf Logo By Merdeka Logo Design Personal Logo Design Logo Design Contest

The Georgia State Income Tax Credit Program for Rehabilitated Historic Property allows eligible participants to apply for a state income tax credit equaling 25 percent of qualifying rehabilitation expenses capped at 100000 for a personal residence and 300000 5 million or 10 million for all other properties.

. Under the I Want Tosection click the Manage my creditshyperlink. Written notification of any changes should be sent to the Department. Production companies sell their Georgia entertainment tax credits to purchasers at discounted rates.

September 8 2020. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Claim Withholding reported on the G2-FP and the G2-FL.

Notice of Tax Credit Transfer IT. 20 Tax Credit Certification Application for Live Action Projects. Includes a promotional logo provided by the state.

Consequently a purchase of 10000 of entertainment credits at 0905 on the dollar costs the purchaser 9050. This rule provides guidance concerning the application and qualification guidelines contained within the Georgia Entertainment Industry Investment Act hereinafter Act under OCGA. All project types are eligible for Georgia film tax credit including game shows talk shows and reality TV.

An additional 10 credit can be obtained if the finished project. Many are unaware of this but Georgia is known as the Hollywood of the South because of all the film productions which choose the state as the location of choice. CurrentHow to Complete the Application.

New Reporting Guidelines at the Georgia Tax Center PDF Form. How-To Directions for Film Tax Credit Withholding. Tax Credit Certification Application Updated 4214 for base 20 credit Application.

Rule 560-7-8-60 Qualified Education Donation Tax Credit. Register for a Withholding Film Tax Account. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

Film Tax Credit Incentive Brochure. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. This application is for Live Action feature films television and.

Production companies are required to submit an application for the tax credit to the DOR within one year from the date that it completes a state certified production and that application will indicate whether the production company intends to utilize an eligible auditor. Georgia Film Office. Applications are submitted to the Georgia Department of Economic Development GDEcD 75 Fifth Street NW Suite 1200 Atlanta Georgia 30308 or email at.

For a project to be eligible for the 20 percent transferable tax credit the Georgia Department of Economic Development must certify the project. Certification for film television projects will be through the Georgia Film Music Digital Entertainment office. This rule provides guidance concerning the application and qualification guidelines contained within the Georgia Entertainment Industry Investment Act hereinafter Act under OCGA.

The state grants an additional 10 credit if the company uses the Made In Georgia logo in its film credits. Select 122 Film Tax Credit from the Credit Typedrop-down menu. Audit Application and Reporting 2 Georgia Department of Revenue July 2021 3.

On average 1 of a Georgia entertainment tax credit may currently be purchased for between 089 to 0925. State of Georgia government websites and email systems use. Production companies get a minimum of 20 tax credit.

In preparation for submitting a Mandatory Film Tax Credit Audit Application the production should have the following document information. The online application for live-action animated or esports projects will ask you to provide a few things. Tax The Georgia film credit can offset Georgia state income tax.

Click the Next button. 2014 10 GEP Logo Tax Credit Application Updated 42514 Form. The best time to submit the application is when the project is green-lit fully funded and ready to open a production office.

This 50000 would apply to current year or prior year taxes owed and any remaining amount could be carried over up to five years. There are three main benefits for purchasing Georgia Entertainment Credits. Most of the credits are purchase for 87-92 of their face value.

159-1-1-01 Available Tax Credits For Film Video or Interactive Entertainment Production 1 Purpose. Important Changes to the Georgia Film Tax Credit. Certification for live action projects will be through the Georgia Film Office.

Click the Request Credit Pre-ApprovalFilm Credit Audithyperlink. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns.

A Base Certification Application may be submitted within 90 days of the start of principal photography. To apply for a voluntary audit a Voluntary Film Tax Credit Application must be completed and submitted to the Department along with a copy of the DECD certification letter and the required fee. DEcD Authorization Certificate Total Qualified Georgia Production Costs Georgia Principal Photography Completion Date Selection of Auditor To Conduct The Audit.

Certification may be applied for within 90 days of the start of principal photography. All production and post-production expenses must be in the state. Georgia Entertainment Industry Investment Act.

New DOR Tax Credit Application After State-Certified Production HB 1037 will now require all production companies who submit an initial application with the. How to File a Withholding Film Tax Return. Film Tax Credit Form IT-FC Form.

Instructions for Production Companies. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Complete the information below listing the primary and secondary representatives who have authority to act on behalf of the firm and who will have overall responsibility for Film Tax Credit audits and meeting eligibility requirements.

So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500. Qualified expenditures include materials services and labor. Applications are to be submitted to the Georgia Film Music Digital Entertainment Office 75 Fifth Street NW Suite 1200 Atlanta GA 30308 or by fax at 4049624053.

Paying less on Georgia income tax. Rule 159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production 1 Purpose. The Georgia film tax credit program accepts applications for live-action projects within 90 days of the start of principal photography but must be done before the end of principal photography.

For independent accounting firms interested in becoming an Eligible Auditor requirements are listed in the Film Tax Credit 3rd Party Eligible Auditor Application. Unused credits carryover for five years.

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Film Incentives And Applications Georgia Department Of Economic Development

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

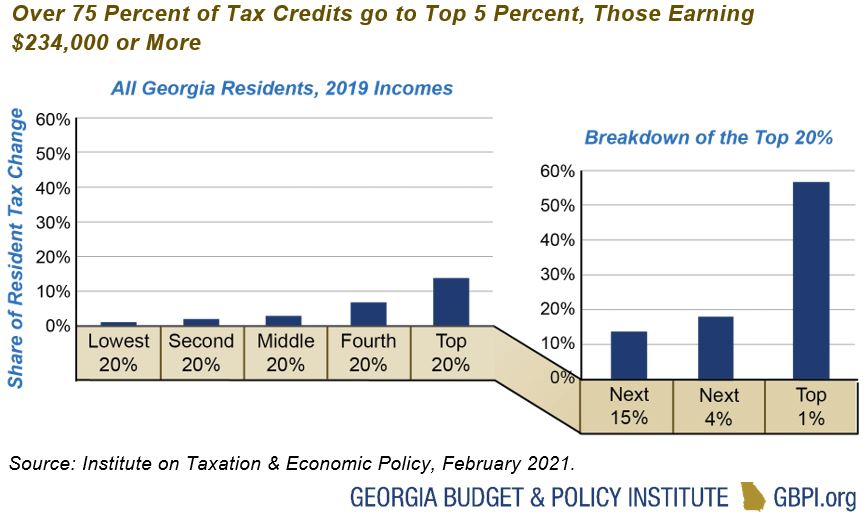

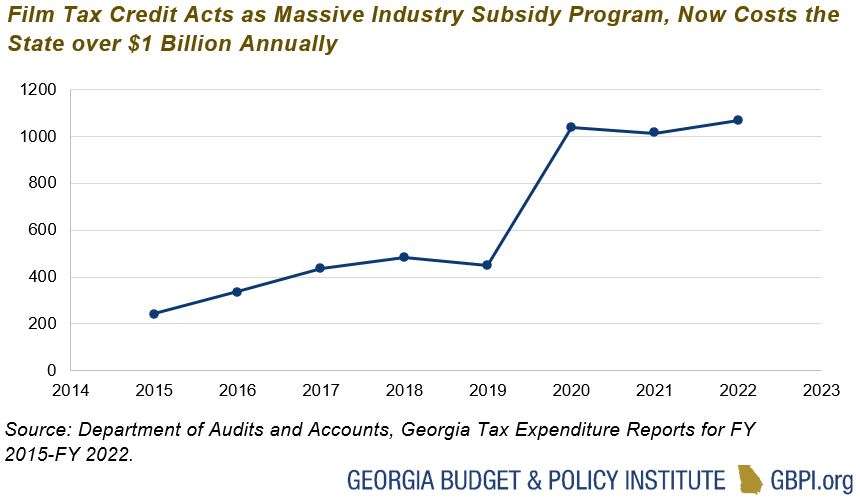

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

The Bowery Went Down To Georgia Georgia Film Savannah Chat

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline

Movies Filmed In Athens Georgia

Celebrating The Georgia Film Industry Stranger Things Filming Locations Georgia Georgia On My Mind

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Senate Won T Cap Film Credit At 900 Million Variety

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute