duluth mn restaurant sales tax

An alternative sales tax rate of 7375 applies in the tax region Saint. Food and Beverage establishments must collect 225 for the Food and Beverage Tax.

You owe use tax when Minnesota City of Duluth sales taxes are not charged on taxable items you buy whether you buy them in Minnesota or outside the state.

. If the items you are buying are for your personal use you can buy up to 770 worth of taxable items during the calendar year without paying use tax. Edina MN Sales Tax Rate. Download all Minnesota sales tax rates by zip code.

Pleaded guilty to two felony counts of aiding in the filing of false tax returns and fifteen felony counts of failing to pay sales tax. Homes for sale near 2210 Duluth Street. Sales History Tax Summary for 2210 Duluth Street.

All Lodging establishments must collect 30 for the Lodging Excise Tax. See details for 2210 Duluth Street Maplewood MN 55109 Single Family 2 bed 1 bath 1440 sq ft 255900 MLS 6243459. 55802 55803 55804 55805 55806 55807 55808 55810 55811 55812 55814 55815 and 55816.

Inver Grove Heights MN Sales Tax Rate. The Duluth Minnesota sales tax rate of 8875 applies to the following thirteen zip codes. The corporation was ordered to.

Find a Sales and Use Tax Rate. Get rates tables What is the sales tax rate in Duluth Minnesota. For more information see Local Sales Tax Information.

Burnsville MN Sales Tax Rate. The minimum combined 2022 sales tax rate for Duluth Minnesota is. You can find more tax rates and allowances for Duluth and Minnesota in the 2022 Minnesota Tax Tables.

The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars. Coon Rapids MN Sales Tax Rate. Recent sales near 2210 Duluth Street.

Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The Duluth sales tax rate is. Sales - Food Most food and drink sold by a food or bar establishment is taxable unless a specific exemption applies.

The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Cottage Grove MN Sales Tax Rate. Duluth in Minnesota has a tax rate of 838 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Duluth totaling 15.

Date Price Change salessaleDate. The County sales tax rate is. Those with more than 30 units must also collect an additional 25 Lodging Tax.

Prepared Food Sales Catering Sales Personal Chef Services Gift Certificates and Gift Cards. This includes bars restaurants food trucks and retailers or others who sell prepared food or drinks. Eagan MN Sales Tax Rate.

Did South Dakota v. Duluth MN Sales Tax Rate. This is the total of state county and city sales tax rates.

Lakeville MN Sales Tax Rate. The Minnesota sales tax rate is currently. Sales are reported and tax collected is remitted to the City of Duluth Treasurer.

Osaka Duluth Inc. See reviews photos directions phone numbers and more for the best Tax Reporting Service in Duluth MN. If however your purchases total more.

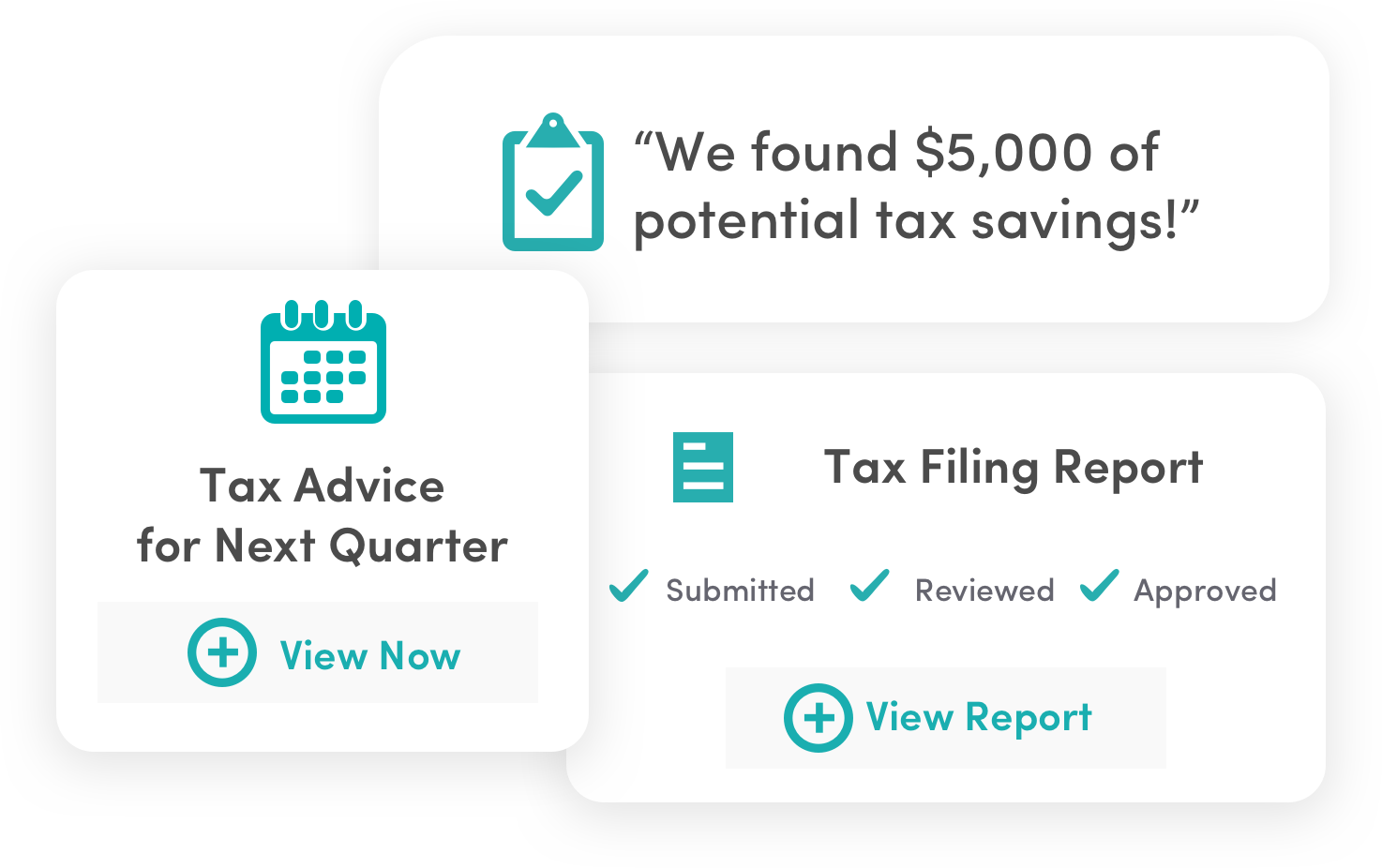

Eden Prairie MN Sales Tax Rate. No Matter What Your Tax Situation Is TurboTax Self-Employed Has You Covered. Ad Uncover Business Expenses You May Not Know About And Keep More Of The Money You Earn.

The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars. The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply.

Essential Business Hi Res Stock Photography And Images Alamy

Sept 8 9 40 Jury Fee 160 Booth Fee Applications Accepted Jan March Wausau Art Outdoor Art

2 Pizza Special Glass Nickel Pizza Co In Wisconsin

Sami Cultural Center Of North America Home Facebook

Rental Accounting Guide To Rental Property Accounting Bookkeeping

/https://s3.amazonaws.com/lmbucket0/media/business/w-central-entrance-trinity-rd-3MSP-1-9wrf397N4hp2F02YwuCi8kRT0rR2DMni1SjQhIQPSYo.4c3085cb12eb.jpg)